Best US Places to Visit in May Without the Crowds

Explore the best US destinations in May that offer mild weather and fewer tourists, from Asheville's...

This article unpacks the cost of living in New Zealand to give you a leg up whether you’re planning a big move or just trying to keep everyday expenses from sneaking up on you.

Understanding how much it would cost to live in New Zealand is absolutely essential for newcomers aiming to get their finances in order.

New Zealand boasts a pretty stable economy, with income levels that are moderate and inflation that stays fairly steady most of the time. Living costs can vary quite a bit depending on where you are. Urban hotspots like Auckland and Wellington usually come with a heftier price tag compared to the quieter, rural areas.

Housing costs tend to eat up the largest slice of the living expenses pie. Rent can really swing depending on the city or type of property. Apartments are generally easier to afford than houses. When it comes to buying a home, you’ll need to come up with a hefty deposit of around 20%.

| City | Average Monthly Rent (NZD) | Median Home Price (NZD) |

|---|---|---|

| Auckland | Around $2,000 for a cozy 1-bedroom | A hefty $1,200,000 |

| Wellington | Typically $1,750 for a 1-bedroom | About $900,000 |

| Christchurch | Roughly $1,300 for a 1-bedroom | Closer to $650,000 |

| Dunedin | Sitting at $1,100 for a 1-bedroom | Around $550,000 |

Tenants and homeowners have to juggle many bills too, including electricity, water, council rates, home insurance and routine maintenance.

Monthly grocery costs can vary depending on whether someone is flying solo or feeding a whole crew. Fresh produce tends to stick to the budget side, especially when you grab it from local markets. However, fancy specialty or imported treats often sneak the total higher.

How much it costs to get around really hinges on whether you’re behind the wheel of your own car or hopping on public transport. Fuel prices in New Zealand usually lean toward the pricier side, and don’t forget to keep parking fees and insurance in mind—they can quietly add up.

Let's dive into the nitty-gritty of healthcare and insurance costs—yes, those bills that sneak up on you when you least expect it. Navigating this maze can be tricky, but understanding the basics helps keep the surprise factor at bay.

New Zealand’s public healthcare system offers broad coverage for residents but you’ll sometimes pay a bit out of pocket for certain services. Many people turn to private health insurance to skip long waits and cover elective procedures not always in the public system. For prescription medicines, you usually chip in some of the cost yourself but there are subsidies for those who meet eligibility criteria.

Finding the right balance between public health services and private insurance often turns out to be a key piece of the puzzle for newcomers aiming to secure timely and comprehensive medical care in New Zealand, notes Dr. Amelia Carter, a healthcare consultant based in Auckland with a knack for cutting through the red tape.

Education costs include free public schooling—which might still sneak in a few fees—private school tuition and university fees that vary between domestic and international students. Additional expenses like uniforms and supplies add to the overall bill.

| Education Level | Typical Cost (NZD) | Notes |

|---|---|---|

| Public Primary/Secondary Schools | Usually free, but expect to chip in about $300-$600 a year | This covers donations and those extra little activity costs that pop up |

| Private Schools | Ranges from $10,000 to $25,000 a year | Varies quite a bit depending on the school's reputation and where it’s located |

| Universities (Domestic) | Typically around $6,000 to $9,000 annually | Thanks to government subsidies, the fees are more manageable here |

| Universities (International) | Generally $22,000 to $35,000 a year | Overseas students should brace for much steeper fees |

| Additional Costs | Usually falls between $500 to $1,000 per year | Think uniforms, supplies, and kicking back into extracurricular activities |

When it comes to utilities and household bills, staying on top of them can sometimes feel like juggling flaming torches—tricky but absolutely essential. Whether it’s electricity, water, gas, or your internet connection, these are the everyday lifelines that keep our homes running smoothly and comfortably. Over time, I’ve noticed that a little bit of savvy budgeting and a watchful eye on usage can save more than just a few bucks—it can spare you some serious headaches down the line. So, while they might not be the most thrilling parts of managing a home, getting a handle on these essentials is always worth the effort.

Monthly household bills typically cover electricity and water plus internet, phone and waste collection—those unavoidable little gremlins of adulting. The costs can really swing depending on how much you use and which providers you pick so it’s a bit of a balancing act.

Leisure spending includes dining out, hobbies, sports, attending cultural and social events, domestic travel and gym memberships.

Let’s dive into the nitty-gritty of taxes and those pesky required contributions that everyone loves to grumble about. While nobody enjoys handing over their hard-earned cash, understanding these obligations can save you from unexpected headaches down the line. So buckle up—doing a little homework here is worth every minute.

New Zealand runs a straightforward but progressive income tax system with several brackets starting at 10.5% for lower earners and climbing to 39% for big earners. Then there’s the Goods and Services Tax (GST) sitting comfortably at 15% that sneaks into the price of most goods and services you buy. On top of that, you have got mandatory bits like ACC levies which cover workplace injury insurance and KiwiSaver contributions designed to boost your retirement nest egg.

When considering how much it would cost to live in New Zealand, budgets can really swing depending on whether you are flying solo, teamed up as a couple or juggling the chaos of raising kids. It also depends on whether you’re tucked away in the countryside or in the middle of a bustling city.

| Expense Category | Single (Urban) NZD | Couple (Urban) NZD | Family (Urban) NZD | Family (Rural) NZD |

|---|---|---|---|---|

| Housing | 2,200 | 3,500 | 4,500 | 3,000 |

| Food & Groceries | 450 | 800 | 1,200 | 1,000 |

| Transportation | 250 | 400 | 700 | 500 |

| Utilities | 180 | 300 | 400 | 350 |

| Healthcare | 100 | 180 | 300 | 250 |

| Education | 0 | 0 | 600 | 500 |

| Entertainment | 250 | 400 | 600 | 450 |

| Taxes & Other | 400 | 700 | 1,000 | 800 |

| Total Monthly | 4,130 | 6,280 | 9,300 | 6,850 |

| Annual Total | 49,560 | 75,360 | 111,600 | 82,200 |

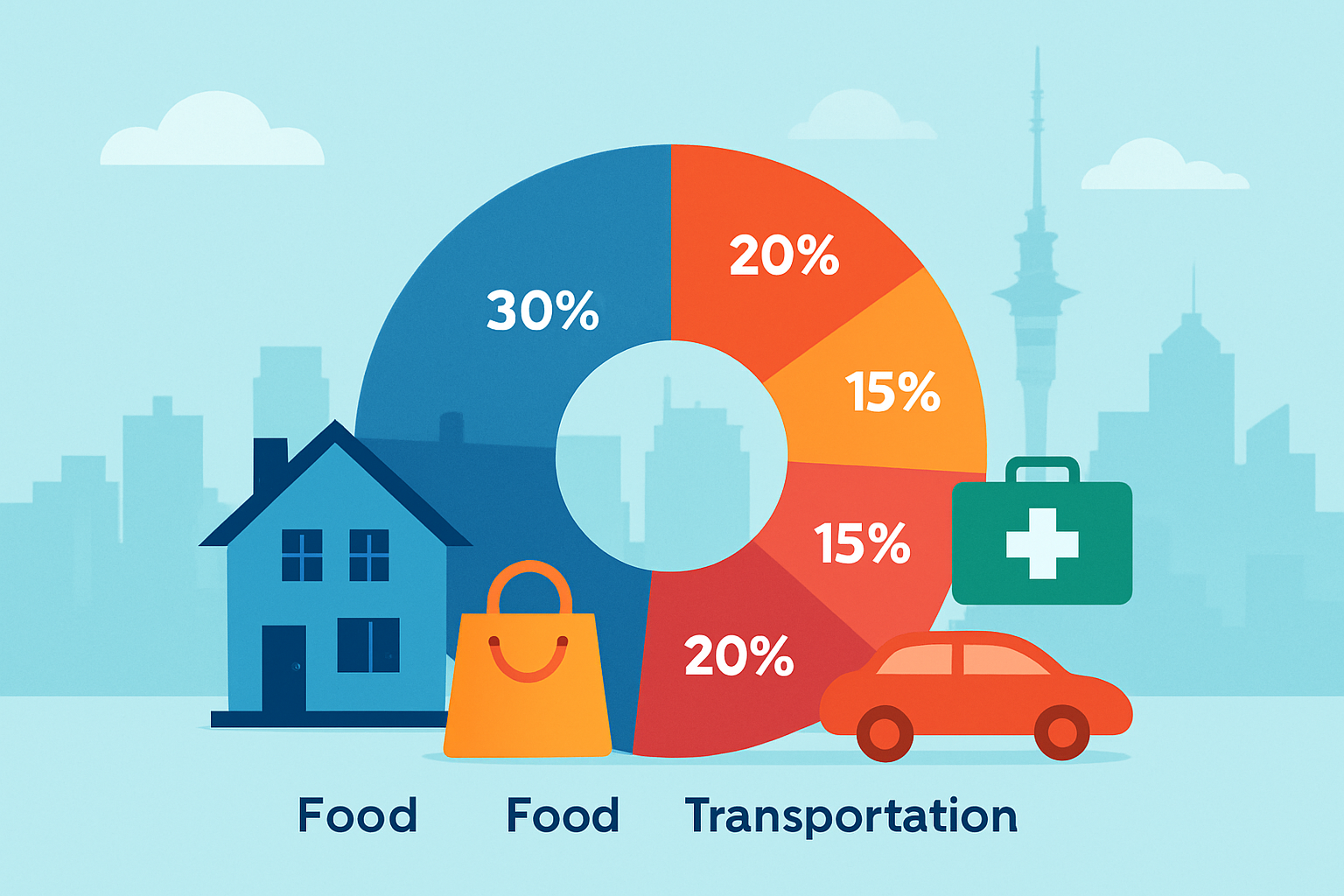

Infographic illustrating average living cost distribution in New Zealand.

23 posts written

Dashiell explores how cities shape human experience, combining architectural insights with sociological observations in thought-provoking pieces.

Read Articles

Explore the best US destinations in May that offer mild weather and fewer tourists, from Asheville's...

Explore Tokyo’s diverse neighborhoods through their unique culinary delights. This guide maps out lo...

Explore Reykjavik like a local with this complete guide to free and affordable activities. From icon...

Planning your first trip to London? Learn how to choose the perfect neighborhood to stay in with exp...